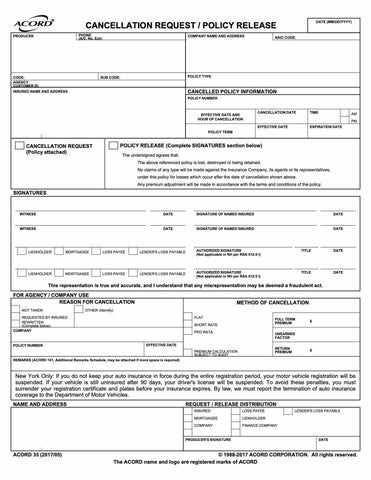

ACORD cancellation form. How to fill form 35 with examples

ACORD Cancellation Form 35: How to Complete the Cancellation Request / Policy Release

ACORD 35 is the standardized Cancellation Request / Policy Release form used across the US and Canada to cancel an insurance policy formally. Whether you're an insurance agency CSR, a broker, or a commercial client handling policy documents, ACORD 35 helps document the insured’s official cancellation instruction.

The form is valid for both personal and commercial lines, including auto, property, general liability, and more. It’s often linked to other standard ACORD documents, such as the ACORD 25 Certificate of Insurance, and is a crucial piece in ensuring clean policy cancellation, risk compliance, and recordkeeping.

In this guide, we’ll walk you through how to fill out ACORD 35 step by step, explain the difference between a policy release and cancellation request, and offer real-world scenarios and tips to avoid E&O risks.

✅ Whether you’re completing this form for a client-requested cancellation, a rewritten policy, or a company-initiated action, this guide gives you everything you need to complete it accurately and compliantly.

What is the ACORD 35 cancellation form?

ACORD 35 is a standardized insurance form used to:

- Request cancellation of an active insurance policy.

- Provide a policy release when the original policy document is lost, retained, or destroyed.

It serves as formal, written documentation of the insured’s instruction to terminate coverage, whether mid-term or at renewal. It is typically stored in both agency and carrier records for compliance.

This ACORD cancellation form can be used for:

- Personal lines (e.g., auto, homeowners, renters)

- Commercial lines (e.g., general liability, commercial auto, property)

Insurers rely on this form for audit trails, regulatory compliance, and third-party notifications.

When do you use ACORD 35?

You’ll use ACORD 35 in any of the following scenarios:

- The insured requests cancellation (e.g., sold the vehicle, moved to a new insurer, or closed the business).

- The policy was never taken or is marked NTU (Not Taken Up).

- The policy is being rewritten under a different carrier or policy type.

- The carrier initiates cancellation due to non-payment, underwriting, or other reasons, and requires formal documentation.

- The policy document is unavailable, and the insured signs a policy release to confirm no further claims will be made.

ℹ️ Remember: Some carriers may also require this form even when a cancellation is submitted through their digital portal.

Key parts of the ACORD 35 form

Before diving into the instructions, here’s what’s on the form:

- Agency and producer details

- Insurance company name and NAIC code

- Insured’s full name and address

- Policy info: number, type, effective & expiration dates

- Cancellation date and time (including AM/PM)

- Method of cancellation: pro rata, short rate, or flat

- Reason for cancellation and who requested it

- Policy release language (if needed)

- Signature section

- Distribution options (insurer, insured, DMV, lienholders, mortgagees, etc.)

Understanding each of these sections is key to filling the form out accurately.

Also read how to write an effective insurance cancellation letter

How to fill out ACORD 35 (step-by-step)

Step 1 – Agency and producer details

Enter:

- Agency name and address

- Producer’s full name and phone number

- Producer/customer ID codes

✅ Tip: Use the exact info from your agency management system to avoid data mismatches with the carrier.

Step 2 – Insurance company and NAIC code

- Enter the carrier's full legal name and NAIC code (if known).

- You can find the NAIC code on the policy declarations page or the state DOI website.

Step 3 – Insured name and address

- Use the legal name of the policyholder.

- For businesses: full registered name.

- For individuals: full legal name and current address.

Step 4 – Cancelled policy information

Fill in:

- Policy number

- Type of policy (e.g., personal auto, commercial property)

- Effective date and expiration date of the policy

🎯 Accuracy here is critical to ensure the right policy is canceled.

Step 5 – Effective date and hour of cancellation

Input:

- Date of cancellation

- Hour and select AM/PM

🕒 Why it matters: Especially for auto policies or property policies with DMV or mortgagee reporting, the exact time can affect compliance and liability coverage.

Step 6 – Method of cancellation and premium handling

Choose one:

- Pro rata – full refund for unused portion (no penalty)

- Short rate – includes a penalty for early cancellation (common if the insured initiates)

- Flat – cancellation from inception; no premium earned

Include return premium calculations if applicable.

✅ Always confirm cancellation method with the insurer. Agencies shouldn't decide this unilaterally.

Step 7 – Reason and type of cancellation

Select the reason:

- Requested by the insured

- Policy not taken

- Rewritten

- Cancellation by the company

- Other: include details like "vehicle sold" or "coverage placed with another carrier."

Step 8 – Policy release statement (if applicable)

This applies when:

- The original policy document is lost, destroyed, or retained

- The insured is confirming they’ll make no further claims after cancellation

⚠️ Signing the policy release means surrendering rights to claim under that policy from the effective cancellation date forward.

Step 9 – Signatures and witnesses

Required:

- Insured's signature (named insured)

- Agency or producer signature, if applicable

- Some jurisdictions may require a witness (check local rules)

Step 10 – Distribution and notifications

Use this section to:

- Indicate where the form should be sent

- Notify mortgagees, lienholders, DMV, loss payees, finance companies, etc.

⚠️ Many states and lenders require written notification when a policy is cancelled—especially for auto or property insurance.

ACORD 35 example – completed cancellation request

Let’s walk through a typical example:

Scenario:

A personal auto policy is being cancelled at the insured’s request due to the sale of the vehicle. The cancellation is pro rata, effective March 15, 2026, at 12:01 PM. The insured requests a refund of unused premium and that the lienholder be notified.

On the form, you'd fill:

- Policy number and type: Auto

- Cancellation date/time: 03/15/2026 – 12:01 PM

- Method: Pro rata

- Reason: Insured request – vehicle sold

- Policy release: Not applicable (policy returned)

- Distribution: Insurer, insured, lienholder (auto loan)

Policy release vs cancellation request – what’s the difference?

Cancellation Request:

- Formal instruction to terminate the policy coverage from a specific date.

- Can be issued regardless of whether the physical policy is returned.

Policy Release:

- Used when the policy document can’t be returned (lost or destroyed).

- Confirms that the insured releases all rights to file claims from the cancellation date onward.

Some carriers require a policy release in addition to cancellation when compliance or lienholder clauses are involved.

Practical compliance tips for agents and CSRs

- ✅ Always get written instructions from the client before initiating cancellation.

- ✅ Confirm new coverage is active before cancelling, to avoid gaps.

- ✅ Double-check: names, policy number, dates, cancellation time.

- ✅ List all required third parties (DMV, lienholder, mortgagee) for distribution.

- ✅ Retain a signed copy of ACORD 35 in the client file, and note any carrier confirmations.

💡 These practices help avoid E&O claims and regulatory issues.

Cancel Progressive Insurance Hassle-Free: Get Email & Talking Point Templates to Make It Easy!

What Happens After Submitting the ACORD Cancellation Form?

After submitting an ACORD Cancellation Form, several key actions typically follow to ensure the policy is properly terminated and all parties are informed:

- Review by Insurance Company: The insurer checks the ACORD Form 35 for completeness, ensuring all details, such as the cancellation reason and effective date, are correct.

- Processing the Cancellation: The insurer updates records to reflect the policy termination based on the information provided in the ACORD Cancellation Form.

- Notification: The policyholder and insurance agent receive confirmation of the cancellation, including the effective date, as proof that the policy has been terminated.

- Refund (If Applicable): The insurer calculates and issues a refund for any unused premium according to the cancellation date on the ACORD Form 35.

- Post-Cancellation Obligations: Policyholders should arrange alternative coverage if needed, as the ACORD Cancellation Form confirms the end of their current policy.

Download the ACORD 35 Cancellation form as a pdf here

Pls download and print the same. Link to download form 35

Closing comments

Each field should be completed carefully to ensure the policy cancellation's accuracy and legality. Always double-check with the insurer's specific requirements and any relevant regulations to avoid issues. If you need more details, it's advisable to contact the insurance company or consult with a legal advisor. This will help prevent potential misunderstandings or legal complications.

It is essential to review the completed form for accuracy and ensure all necessary information is included. The process may vary slightly depending on the insurance company's specific requirements or state regulations. Always check with your insurer or legal advisor if you need clarification on completing the form.

Links to other ACORD forms

2 comments

FAQs

ACCA blogs

Follow these links to help you prepare for the ACCA exams

IFRS blogs

Follow these blogs to stay updated on IFRS

Formats

Use these formats for day to day operations

- Account closure format

- Insurance claim letter format

- Transfer certification application format

- Resignation acceptance letter format

- School leaving certificate format

- Letter of experience insurance

- Insurance cancellation letter format

- format for Thank you email after an interview

- application for teaching job

- ACCA PER examples

- Leave application for office

- Marketing manager cover letter

- Nursing job cover letter

- Leave letter to class teacher

- leave letter in hindi for fever

- Leave letter for stomach pain

- Leave application in hindi

- Relieving letter format

Interview questions

Link for blogs for various interview questions with answers

- Strategic interview questions

- Accounts payable interview questions

- IFRS interview questions

- CA Articleship interview questions

- AML and KYC interview questions

- Accounts receivable interview questions

- GST interview questions

- ESG Interview questions

- IFRS 17 interview questions

- Concentric Advisors interview questions

- Questions to ask at the end of an interview

- Business Analyst interview questions

- Interview outfits for women

- Why should we hire you question

leave application format

- Leave application for office

- Leave application for school

- Leave application for sick leave

- Leave application for marriage

- leave application for personal reasons

- Maternity leave application

- Leave application for sister marriage

- Casual leave application

- Leave application for 2 days

- Leave application for urgent work

- Application for sick leave to school

- One day leave application

- Half day leave application

- Leave application for fever

- Privilege leave

- Leave letter to school due to stomach pain

- How to write leave letter

Insurance blogs

- Sample letter of appeal for reconsideration of insurance claims

- How to increase insurance agent productivity

- UAE unemployment insurance

- Insurance cancellation letter

- Insurance claim letter format

- Insured closing letter formats

- ACORD cancellation form

- Provision for insurance claim

- Cricket insurance claim

- Insurance to protect lawsuits for business owners

- Certificate holder insurance

- does homeowners insurance cover mold

- sample letter asking for homeowner right to repair for insurance

- Does homeowners insurance cover roof leaks

Admission cancel 11th class

Clearly, many thanks for the help in this question.

Leave a comment