ACCA Exemptions Calculator 2026

ACCA Exemptions Calculator 2026: Check Your Eligibility & Save Time

Every time a CA finalist or B.Com graduate calls Eduyush about starting ACCA, the first question is always: "How many papers can I skip?" The answer isn't universal—it depends on your exact qualifications, the subjects you covered, and when you completed them—but it can dramatically change your ACCA journey from 13 exams down to as few as 4.

The ACCA Exemptions Calculator is the tool that gives you that answer in under 2 minutes. This guide walks you through how the calculator works, which qualifications unlock which exemptions, the exemption fees for 2026 (with GBP to INR at ₹122), and how Eduyush helps students save up to 50% on first-year exemption fees.

What Is the ACCA Exemptions Calculator?

The ACCA Exemptions Calculator is an official online tool provided by ACCA that matches your educational background or professional qualifications against ACCA's exemption framework and tells you which of the 13 ACCA papers you can skip.

Instead of sitting an exam, you pay an exemption fee per paper and move directly to the next level. This saves you:

- Study time: Months of preparation per exempted paper

- Exam fees: No need to pay exam entry fees for exempted papers

- Books and coaching: Skip materials and classes for papers you already know

The calculator covers degrees (B.Com, M.Com, MBA), professional qualifications (CA, CPA, CMA, CIMA, ICAEW), and diplomas (AAT, DipIFR).

💡 Pro tip from experience: Always check exemptions before you register with ACCA. Students who register first and apply for exemptions later sometimes miss discount windows or pay unnecessary exam fees.

Who Is Eligible for ACCA Exemptions in 2026?

ACCA exemptions are based on substantial content overlap between your prior studies and ACCA's syllabus. Here's a realistic breakdown by qualification type.

1. ACCA Exemptions for Degree Holders (India)

| Qualification | Typical Exemptions (Papers) | Number Exempted |

|---|---|---|

| B.Com (3-year) | BT, MA, FA, LW (varies by university) | 4 papers |

| M.Com | BT, MA, FA, LW, plus sometimes TX | 4–5 papers |

| MBA (Finance) | BT, MA, FA (depends on specialization and university) | 3–4 papers |

| DipIFR (ACCA) | FR (if DipIFR completed successfully) | 1 paper |

Reality check: Indian B.Com exemptions have evolved. Post-2023, some universities that updated their syllabi now offer the TX (Taxation) exemption as well, but this is not automatic—check with your specific university using the ACCA calculator or Eduyush.

2. ACCA Exemptions for Chartered Accountants (CA, CPA, ICAEW)

| Certification | Typical Exemptions | Number Exempted | Papers Remaining |

|---|---|---|---|

| CA Inter (India) | BT, MA, FA, LW, TX, AA | 6 papers | 7 papers |

| CA Final (India) | BT, MA, FA, LW, TX, AA, PM, FR, FM | 9 papers | 4 papers |

| US CPA | Varies by subjects passed; typically BT, MA, FA, LW, AA, FR, FM | 7–9 papers | 4–6 papers |

| ICAEW, ICAS | Significant exemptions across Applied Skills and sometimes Strategic Professional | 7–10 papers | 3–6 papers |

CA Final holders get maximum exemptions, often leaving only SBL, SBR, and two options (e.g., AFM + APM). This is why "ACCA after CA" is so popular—you can complete the global credential in 6–12 months.

For a complete analysis of this route, see our ACCA After CA guide.

3. ACCA Exemptions for CMA India (ICMAI)

| ACCA Paper | CMA/ACMA | FCMA |

|---|---|---|

| Business & Technology (BT) | ✅ | ✅ |

| Management Accounting (MA) | ✅ | ✅ |

| Financial Accounting (FA) | ✅ | ✅ |

| Corporate and Business Law (LW) | ✅ | ✅ |

| Performance Management (PM) | ❌ | ✅ |

| Financial Management (FM) | ✅ | ✅ |

| Audit and Assurance (AA) | ❌ | ✅ |

| Financial Reporting (FR) | ✅ | ✅ |

ACCA Exemption Fees 2026 (Updated for GBP ₹122)

Exemptions are not free—you pay a fee per paper to claim each exemption.

| Exam Level | Fee per Paper (GBP) | Fee per Paper (INR at ₹122) |

|---|---|---|

| Applied Knowledge (BT, MA, FA) | £86 | ₹10,492 |

| Applied Skills (PM, TX, FR, AA, FM, LW) | £114 | ₹13,908 |

Example cost calculation for a CA Final holder:

- 3 Applied Knowledge exemptions: 3 × ₹10,492 = ₹31,476

- 6 Applied Skills exemptions: 6 × ₹13,908 = ₹83,448

- Total exemption fees: ₹1,14,924

Compare this to exam fees for 9 papers (roughly ₹1,60,000–₹2,00,000) plus study materials and hundreds of study hours, and exemptions clearly save money and time—even after paying the exemption fees.

How to Save on Exemption Fees

💡 Eduyush exclusive: Students who register through Eduyush can save up to 50% on first-year exemption fees, bringing a ₹1,14,924 bill down to ₹57,462.

This discount is available through Eduyush's ACCA partner network and applies when you register and claim exemptions within your first year. Contact +91 96433 08079 or check the ACCA Registration with Training page for current offers.

How to Apply for ACCA Exemptions in 2026

Here's the step-by-step process, with realistic timelines.

Step 1: Check Your Eligibility

Use the official ACCA Exemptions Calculator at accaglobal.com or speak directly with the Eduyush team (faster for Indian qualifications).

Time required: 2–5 minutes online, or 10–15 minutes on a call with Eduyush.

Step 2: Gather Required Documents

You'll need:

- Final degree certificate or provisional certificate

- Complete transcripts showing subjects and marks

- Professional qualification certificate (if claiming CA, CPA, CMA, etc.)

- Passport or national ID for identity verification

Tip: Ensure documents are clear scans or certified copies—blurry mark sheets delay processing.

Step 3: Contact Eduyush for Discount Eligibility

Before you submit your exemption application, reach out to Eduyush to check whether you qualify for the 50% first-year exemption fee discount. This step alone can save you ₹50,000–₹60,000.

Contact: +91 96433 08079 (WhatsApp preferred for faster response)

Step 4: Submit Application via MyACCA

- Log into your MyACCA account (or create one if you haven't registered yet)

- Navigate to Exam entry > Apply for exemptions

- Upload your documents in the required formats

- Select the papers you're claiming exemptions for

Step 5: Pay Exemption Fees

Once ACCA approves your eligibility, you'll receive a payment request. You must pay within 30 days to confirm your exemptions.

Payment methods: Same as ACCA exam fees—international credit/debit card or bank transfer.

Step 6: Wait for Confirmation

ACCA reviews straightforward exemption applications within 1–2 weeks . Complex cases (non-standard degrees, international qualifications) can take 3–4 weeks.

You'll receive email confirmation once exemptions are formally granted.

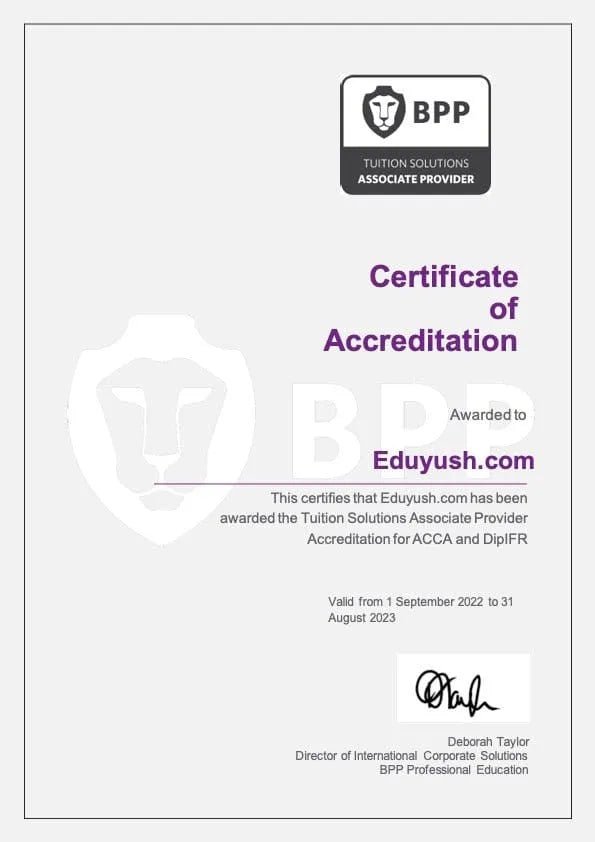

Pass the ACCA Diploma in IFRS exams with us in your first go

Why Claiming ACCA Exemptions Matters

Beyond the obvious time and cost savings, exemptions change how you experience ACCA.

| Benefit | Details |

|---|---|

| Faster qualification | CA Final holders can finish ACCA in 6–12 months vs 2–3 years |

| Lower total cost | Save on exam fees, books, coaching for exempted papers |

| Higher motivation | Starting at Applied Skills or Strategic Professional feels more engaging than doing foundation papers you've already mastered |

| Immediate career impact | Shortening ACCA to 4–6 papers means you can add "ACCA-qualified" to your CV much sooner |

Real example from 2025 cohort: A CA Final candidate registered with Eduyush in January, claimed 9 exemptions with the discount (total cost ₹57,000), sat 4 Strategic Professional papers between March and September, and was ACCA-qualified by October—total journey under 10 months.

Should You Always Claim Exemptions?

In 99% of cases, yes—but there are rare exceptions.

When exemptions make sense (almost always):

- You passed the equivalent subject with reasonable marks

- The exemption fee is lower than (exam fee + study cost + time)

- You want to finish ACCA quickly

When you might skip exemptions (uncommon):

- You barely passed the subject years ago and genuinely don't remember the content—retaking might give you a stronger foundation

- The exemption fee plus study for the next level is actually higher than just sitting the easier paper

From experience, <5% of eligible students choose not to claim exemptions, and most of those cases involve Knowledge Level papers where exam fees are lower anyway.

Next Steps: Start Your ACCA Journey with Exemptions

Now that you know how exemptions work and how much you can save:

- Check your exact exemptions using the ACCA calculator or by calling Eduyush at +91 96433 08079

- Review total ACCA costs with exemptions factored in: ACCA Course Fees 2026

- Understand the whole syllabus for papers you'll actually sit: ACCA Subjects Guide

- Plan your exam schedule with the 2026 calendar: ACCA Exam Dates 2026

- Register with discount support through Eduyush: ACCA Registration with Training

For exemption application support, document review, or questions about discounts, reach out to us at +91 96433 08079 or via our contact page.

Authored by Vicky Sarin, CA, who has guided hundreds of Indian CAs, CMAs, and commerce graduates through ACCA exemptions, registration, and fast-track qualification pathways since 2016.

ACCA Exemptions. Questions? Answers.

Is it worth doing ACCA with 9 paper exemptions?

Absolutely. With 9 exemptions (typical for CA Final), you only sit 4 Strategic Professional papers, which takes 6–12 months and costs ₹57,000 exemption fees + ₹96,624 exam fees + study materials. This gives you a globally recognized qualification much faster than starting from scratch.

What exemptions do CA IPCC/Inter pass holders get?

CA Inter holders typically get 6 exemptions: BT, MA, FA, LW, TX, and AA. You'll still need to sit PM, FR, FM, plus all 4 Strategic Professional papers (total 7 papers).

Should I do ACCA during CA or after CA Final?

Most students find it easierafter CA Finalwhen you have max exemptions (9 papers) and can finish ACCA in under a year. During CA, you're juggling articleship, CA exams, and limited time. See ourACCA After CAanalysis for detailed ROI.

Is ACCA tougher like CA, CMA?

The answer is Yes and No

Yes :

1) Your conceptual clarity needs to be higher

2) The ACCA strategic professional level exams are case study based. This will require skillsets in exam technique and communication

3) Rote learning will not help

4) Marks are awarded for good and bad answers rather than the solution.

No:

1) Unlike CA, you don't need to write in groups. so you can schedule one exam at a time and clear it. You need to score 50% to clear the subject individually

2) You can schedule your papers quarterly

3) Plenty of ACCA resources on-site that will guide you on how to plan your studies.

Is a qualified CA required to undergo practical training of ACCA?

To become a member of ACCA and qualify as a professional accountant, your must complete the Practical expereince Requirements (PER).

There are three components to the PER:

1) completing 36 months' employment in an accounting or finance-related role or roles

2) achieving five Essentials and at least four Technical performance objectives to the satisfaction of your practical experience supervisorrecording and

3) reporting your PER progress through the onlineMy Experiencerecord.

Since you are already a CA, your articleship expereince should siffuce all points especially towards point 1 and 2. If you are missing out on any of objectives in point 2, you can still gain that though work expereince.

Leave a comment