AICPA Taxation of Corporations - Tax Staff Essentials

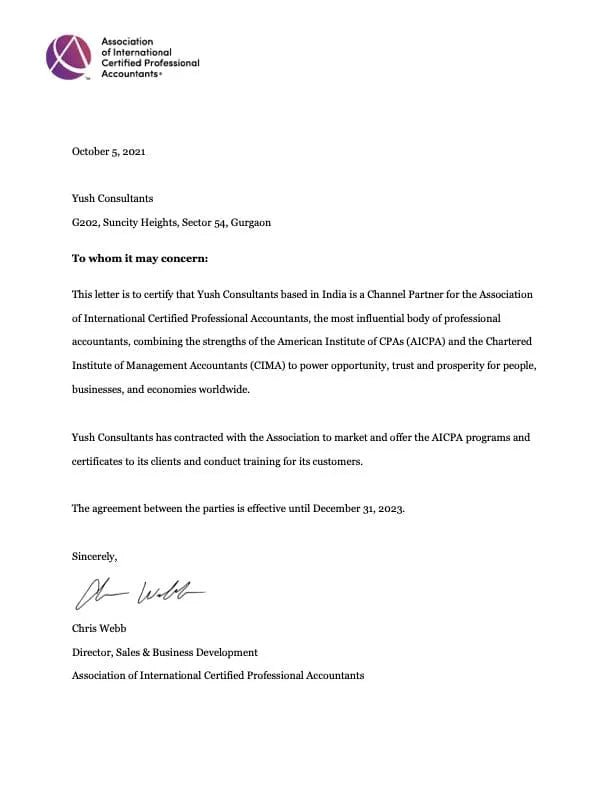

- Eduyush is an approved AICPA channel partner

- Get 10.5 CPE hours

- Whatsapp +919643308079 to know more

- We display prices in local currency, checkout is in Indian rupee

- Access 1 year from date of activation

Who is AICPA?

AICPA (the Association) represents AICPA® & CIMA®.

The Association has over 696,000 members in 192 countries. AICPA is the worldwide leader on public and management accounting issues through support for the CPA license, specialized credentials, professional education & thought leadership.

Taxation of Corporations – Tax Staff Essentials

Gain Expertise in Corporate Taxation and Optimize Tax Strategies for Businesses

The Taxation of Corporations – Tax Staff Essentials course provides a comprehensive understanding of C corporation taxation, including key tax-saving opportunities, compliance requirements, and corporate tax structures. This course helps tax professionals navigate income tax accounting, return positions, tax credits, and corporate tax strategies.

- CPE Credits: 10.5

- Level: Intermediate

- Format: 100% Online, Self-Paced

- Access: 1-Year

- Author: AICPA & CIMA Staff

Why Take This Course?

This course covers essential corporate tax concepts and equips professionals with the skills needed to evaluate entity structures, tax deductions, and reporting requirements.

- Learn the pros and cons of C corporations and when S corporation taxation is beneficial.

- Understand corporate alternative minimum tax (AMT), capitalization, and amortization rules.

- Explore accounting methods available for corporations and compliance requirements.

- Analyze real-world case studies on corporate formation, deductions, and tax credits.

Who Should Enroll?

This program is designed for tax professionals specializing in corporate taxation and entity structuring, including:

- CPAs and Tax Accountants handling corporate tax filings.

- Corporate Tax Advisors guiding clients on C corporation and S corporation taxation.

- Finance Managers and Controllers overseeing corporate tax planning.

Key Topics Covered

- Formation of corporations and entity structuring strategies

- Section 1244 stock and tax benefits for small businesses

- Net operating losses (NOLs) and their impact on tax planning

- Corporate tax deductions (charitable contributions, rent, interest, and more)

- Schedules M-1 and M-3 for corporate tax return reconciliation

- Tax credits available to corporations and their strategic application

Learning Outcomes

By completing this certificate, you will:

- Analyze tax-saving opportunities and requirements related to Section 1244 stock.

- Identify allowable accounting methods for corporations.

- Determine corporate net operating loss (NOL) deductions.

- Recognize various business tax credits available to corporations.

- Identify the features of a parent-subsidiary or brother-sister group of corporations.

- Understand intragroup transactions and their tax implications.

CPE Credit & Course Details

- Format: Online, Self-Paced

- CPE Credits: 10.5

- NASBA Field of Study: Taxes

- Level: Intermediate (Basic knowledge of income taxation recommended)

- Access Duration: 1 Year

- Enroll today and enhance your expertise in corporate taxation.

Why Buy from Eduyush?

- AICPA Authorized Channel Partner – Get official AICPA courses with verified certification.

- Exclusive Discounts – Save Up to 45% – Get the best pricing on ethics CPE courses.

- Trusted by 500+ Global Finance Professionals – Over 500 five-star reviews from professionals worldwide.

- Access with 1-Year Learning Flexibility – Study at your own pace, anytime, anywhere.

Benefit from Special Eduyush Pricing

Eduyush offers exclusive India pricing for this certificate, making it more accessible to professionals looking to build data analytics skills. As an authorized AICPA channel partner, Eduyush provides authentic AICPA courses at competitive prices.

🔗 Verify Eduyush as an AICPA Partner on the Official AICPA Page: AICPA Channel Partners

Limited-Time Discounts Available – Enroll Now and Save