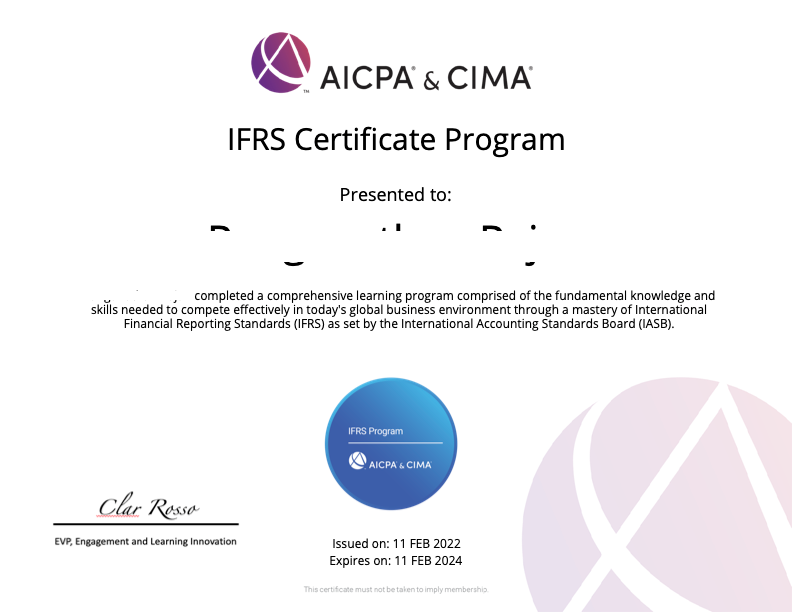

AICPA IFRS Certification program: Get Digitally Badged

-

-

-

-

-

🌍 Global Recognition

- Only globally approved IFRS credential (195+ countries)

- Backed by world's largest accounting body (650,000+ AICPA members)

- Official IFRS status - authorized to use "IFRS" designation

- Preferred by Fortune 500 companies worldwide

- Recognized by international financial authorities

🚀 How It Works

- Self-paced online learning (1-year access)

- Complete modules at your convenience

- Take assessment & earn certification

- Get official AICPA digital badge

- Showcase expertise on LinkedIn

🔐 Digital Credibility

- Credly digital badge - trusted by recruiters in 150+ countries

- LinkedIn integration - verified skills worldwide

- AI-compatible - optimized for global job searches

- Fraud prevention - secure credential system

- Instant verification worldwide

⚡ Exclusive Free Course Opportunity

🎁 How to Get Your Free Course

3 Simple Steps:

✅ Step 1: Complete all 18 IFRS modules within 60 days

✅ Step 2: Share your digital badge on LinkedIn and tag @eduyush.com

✅ Step 3: Get your AICPA certification within 7 working days

🚀 Why This Matters:

- Boost your career with IFRS expertise

- Stand out on LinkedIn with verified skills

- Open doors to new opportunities and promotions

- Show commitment to professional growth

📸 Real Reviews from Real Students

Read what prior students have said on the AICPA IFRS certification

- Rawther Riswan - Trials and tribulations of doing the AICPA IFRS

- Felix John - Is AICPA IFRS worth the hype?

📸 Eduyush reviews

- Trustpilot.com rated 4.7/5 over 300 reviews

- Judge.me over 800 revie

⭐ Eduyush Advantage

- Official AICPA channel partner

- Exclusive 70% discount only through Eduyush

- 3 months complimentary IFRS lectures

- Expert guidance & best learning experience

- Verified credentials on AICPA website

🎓 Who Should Enroll

- CAs, CPAs, ACCAs & finance professionals

- Audit & tax professionals with IFRS exposure

- Finance managers, controllers & CFOs

- Graduates seeking global finance careers

- Anyone in financial reporting or international accounting

🎯 What You'll Learn: IFRS Topics

Course coverage:

* IFRS: The Conceptual Framework for Financial Reporting and Fair Value Measurement (IFRS 13)

* Presentation of Financial Statements (IAS 1) & Events After the Reporting Period (IAS 10)

* Accounting Policies, Changes in Accounting Estimates and Errors (IAS 8)

* Inventory (IAS 2)

* Property, Plant and Equipment (IAS 16) and Borrowing Costs (IAS 23)

* Investment Property (IAS 40)

* Intangible Assets (IAS 38)

* Impairments (IAS 36)

* Non-Current Assets Held-for-Sale and Discontinued Operations (IFRS 5)

* Government Grants (IAS 20)

* Leases (IFRS 16)

* Financial Instruments (IAS 32, IFRS 9, IFRS 7)

* Provisions, Contingent Liabilities, and Contingent Assets (IAS 37)

* Income Taxes (IAS 12)

* Employee Benefits (IAS 19)

* Share-Based Payment (IFRS 2)

* Revenue from Contracts with Customers (IFRS 15)

* Related Party Disclosures (IAS 24)

* Consolidated Financial Statements (IFRS 10) & Separate Financial Statements (IAS27)

* Business Combinations (IFRS 3)Investment in Associates and Joint Ventures (IAS 28) & Joint Arrangements (IFRS 11)

* Foreign Exchange Rates (IAS 21)

* First-Time Adoption of IFRS (IFRS 1)

* Statements of Cash Flows (IAS 7) and Interim Reporting (IAS 34)

* Earnings per Share (IAS 33)

Insurance Contracts (IFRS 17)